Online Banking System in Bangladesh: A- Z Guideline

Do you ever use online banking in Bangladesh? Isn't this banking system extremely smooth and efficient? The growing usage of the Internet and the availability of smartphones have vastly facilitated the online banking system in Bangladesh.

Standard Chartered introduced online banking in Bangladesh two decades ago. Since then, the entire banking industry has used this system.

According to the Dhaka Tribune, online banking users in Bangladesh nearly tripled from 2010 to November 2023, reaching 8.1 million. The net income in the online market is forecasted to reach US$21.48bn in 2024.

Online banking enables users to make transactions through a bank's website or mobile apps. Bankers say this system is safe and convenient.

In this blog, I will demonstrate the importance, prospects & how the online banking system in Bangladesh works & its success stories.

What is an Online Banking System?

An Online banking system is the easiest way to conduct banking financial transactions through the Internet. The great thing is that you can access your bank account through the bank's website or mobile app. You can access almost every banking service, including transfers, transactions, and deposits via the Internet.

The online banking system in Bangladesh enhanced the e-banking sector with digital innovation and mobile banking services. This system has brought banking services to a wide range in Bangladesh by reducing the cost of banking services. This system is useful for businessmen, entrepreneurs or freelancers who need banking transactions on the go.

Evolution of online banking in Bangladesh

The history of the online banking system in Bangladesh refers to its emergence in the early 2000s. It was introduced as a solution to traditional banking.

Nowadays, people don't go for just inquiries at the bank with chequebook like before. Instead, they intend to go for the online baking service.

Although standard chartered banks first launched online banking services, almost every bank is offering this service. You can get every online banking service from all online banks in Bangladesh, for example:

- City Bank

- BRAC Bank

- Bank Asia Limited

- Standard Charted Bank

- Habib Bank Limited

- Bangladesh Krishi Bank

- Agrani Bank PLC

- Jamuna Bank Limited

- Meghna Bank Limited

- Commercial Bank of Ceylon

These banks have Internet banking apps, such as City Touch, EBL Sky Banking, Brac Bank Aastha, and SC Mobile Banking.

The online banking system in Bangladesh has a host of reasons for its robust development. The demand for rapid banking, competition, e-commerce trending, increased financial literacy rate, and fintech have improved online banking efficiency.

During the global pandemic, online banking users were 2.7 million. However, this number of users has significantly grown and reached 8.1 million in November 2023.

Studies show that online banking and app transactions between April and September 2023 were Tk45000 Cr. In November 2023, compared to October 2023, there was 80% growth in November Tk82000 Cr, while mobile banking slightly decreased. Also, Foreign currency transactions through bank card was Tk798 Cr. (Source: Bangladesh Bank Data)

- Through online banking, the maximum limit for individual customers per transaction is Tk3 lac per day. The maximum frequency is ten times, and the maximum limit is Tk10 lacs per day.

- A corporate customer's maximum transaction limit is TK5 lacs per day. Also, their maximum frequency is 20 times, and their limit is TK25 lacs per day.

What are the Benefits of Online Banking System?

Online banking systems operate online banking services through digital channels such as websites and mobile apps. However, let's discuss the benefits of online banking systems:

- Verified admittance to accounts through desktop

- Speedy accessible

- Offer paperless banking and decrease the storage

- Enhanced advanced data security protection with 2-factor data authentification

- Enterprise-wide access data

- Check your banking details quickly

- Deposit the balance

- Withdrawal of balance

- Offer a cheaper transaction process than a traditional payment system

- Allow convenient banking conduction from home

- Minimize the emergence of money laundering

- Reduce the risk of online fund transferring

- Non-complex adaptability to synchronize with varying framework necessity

Why is Online Banking System Important in Bangladesh?

Many users significantly access their banking access via online banking systems. Almost every traditional banking service are available through online banking, including, deposits, bill payments, loan applications etc. Here are some advantages of the online banking system given below:

Bill Payments

You can pay all kinds of utility bills without any hassle. Users also can review the current market situation and policies.

Fund Transfer

You can easily transfer funds to desired users' accounts from one distance to another distance. Send your funds into an account. You can receive funds from other accounts to your user account through a bank site.

Apply for Credit

In case your balance is short, you can apply for credit. You just need to apply through your banking account on the Internet.

Online Shopping

You can buy any product via an online bank account payment system without going to a Store or market.

Loan Applications

As information is more available online than ever before, you can easily search for the best loan rates and apply.

Verify Account Transactions and Balances

Online banking makes it easy to check your account balance and review transaction history in real time. You can access your balance, transaction history, and account statement whenever needed.

Cardless ATM withdrawal:

You don't need to hold your account card to withdraw money. One of the great advantages of online banking is that it is a timeless and paperless process.

Instant Online Application And Approvals

Another benefit of the online banking system is it works instantly and simultaneously. If you need transactions, you can access your online bank account instantly and get approvals.

Extended 24/7 Online Customer Service

If you face any trouble, even at midnight, you can get help from the customer service of an online bank. This great support of an online bank helps to boost the popularity of online banking.

Saves time

The online banking system has made banking solutions more accessible and time-consuming. You can make instant banking transactions without any trouble. For example, Brac Bank Astha offers a digital mobile banking experience while saving time and money.

Cost Reduction

On the other hand, the cost per transaction is not as high as the minimum price. And this cost is decreasing day by day throughout the world.

How does an Online Banking System Work?

An ultimate banking software conducts and manages banking's primary operations. A complete core banking solution allows you to perform transactions from any branch. You don't have to be limited to that specific branch where you opened your accounts.

On the other hand, an online banking system conducts online banking processes to give you banking services online. When you start using a banking account online, this system provides banking services without delaying or missing a scheduled appointment. You can download your banking app from your device's app store.

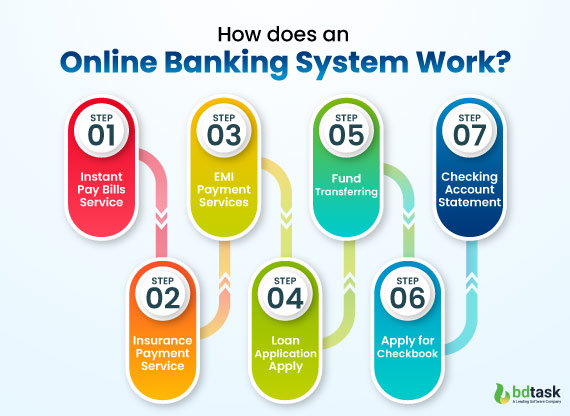

However, online banking system in Bangladesh frequently conduct seven banking processes:

1. Instant Pay Bills service:

Almost every corporate office offers a digital infrastructure that enables you to pay online for their services. Consequently, you can avoid visiting their office to pay bills.

Therefore, you can pay your utility bills like gas, current, and water bills through an online payment. After all, Online banking systems offer instant pay bill service to make your life easier.

2. Insurance Payment Service:

Online banking offers to pay your insurance payment, which requires you to follow the timeline to avoid penalties. It allows you to select "standing instructions" for specific dates so you can't miss payment dates or incur a fine.

3. EMI Payment Services:

This system allows you to pay your electronic monthly installments or EMIs. You can pay EMI bills using online banking with security.

4. Loan Application Apply:

The online banking system enables you to apply for a loan by filling out the loan application form. In addition, they can verify your credit score to approve your loan request. If you fulfill all criteria and are approved, you will get a loan and smoothly pay for it online.

5. Fund Transferring:

You can easily send funds from your online bank account to any other bank account. Otherwise, you can select "Standing Instruction" to repeat transfers periodically.

6. Apply for checkbook and Devit or Credit Card:

You can apply for a checkbook, debit card, or credit card online. You can perform all banking process without any trouble or visit the bank physically. Online banking is the easiest way to get banking facilities in a handicap that you have been using.

7. Checking Account Statement & operate:

You can track your account and transactions using online banking without visiting a bank. Furthermore, online banking statements can allow you to deliver your transaction statement to your email address whenever you request.

Learn How to Open an Online Banking Account on your Own

After browsing or downloading banking websites or mobile apps, you can follow some steps to open a bank account online:

- Firstly, you have to register as a user, which bank links to your profile. Create a real username following your national ID and a unique password to open your account.

- You also need to complete the KYC (Know Your Customer) forms and provide the required documents. These could be a National ID card, passport-size picture, TIN certificate, etc. Banks actually verify you with this information.

- The important thing is that you need an active local debit card to access your online transactions.

- You will view your account information just after logging in. You can now operate financial transactions and B2B payments through your online account. The online banking system provides advanced security measures, so your account will be safe from unauthorized access.

Discover Online Payment System in Bangladesh Bank

The Bangladesh Electronic Transfer Network (BEFTN) is a multilateral electronic clearing system. This system facilitates processing and delivery for the distribution and settlement of electronic and debit transactions among participating banks. Besides, international payment networks like Visa, American Express, and Master Card are accepted to make payments conveniently.

Bangladesh Bank's responsibility is to regulate and oversee the country's payments system and services. Moreover, all departments work to ensure safe and efficient payment systems according to international standards.

Currently, Bangladesh Bank offers four major bank payment systems. Three of these are for Retail Value: Bangladesh Automated Cheque Processing System (BACPS), Bangladesh Electronic Funds Transfer Network (BEFTN), National Payment Switch Bangladesh (NPSB), and the other one is High-Value Bangladesh Real Time Gross Settlement (BD-RTGS) System.

So, you can transact in high volume through RTGS, while the BEFTN helps to facilitate and complete the retail transaction. Furthermore, Bangladesh Bank provides licenses to operate e-money services, mobile financial services, and internet-based payments.

Case Studies and Success Stories of Online Banking in Bangladesh

Online Banking has transformed Bangladesh's financial landscape, empowering individuals and businesses with access to financial services. Banks have revolutionized traditional banking practices with the use of innovative financial technology, efficiency & inclusivity. Let's discuss the success stories and case studies of the online banking system in Bangladesh:

- Online banking systems offer banking services exclusively online, enhancing your experience and satisfaction without the need to visit physical branches.

- You can conduct your activities online, including transferring money, making payments, and carrying out transactions.

- Online banking can use technology-based products like virtual card numbers and QR codes to make transactions convenient.

- Banks take different types of skills and Training Enhancement projects or programs as a part of their goal. These program helps to deliver financial education, communication skills, health & hygiene, access to online banking services, and growing confidence levels.

Now, come to the success story. One notable success story involves a small entrepreneur in a rural village named Sumaiya. She can now manage her business seamlessly through online banking, breaking her geographical barriers.

Brac Bank introduced a digital banking app, Astha, in 2021. This online banking app crossed the transaction volume of Tk10000 crore in March 2024. It is a record for app-based transactions for a single month. Furthermore, more than 238,000 users used this app to make 2.1 million transactions.

Another case study in Bangladesh's banking industry is Grameen Bank. Grameen Bank has reached out to poor people to fill their credit needs at low prices. This microfinance banking sector focuses on rural areas to develop their financial landscapes.

Obstacle of Online Banking in Bangladesh: Challenges and Limitations

Everything has ups and downs, and so does the online banking system in Bangladesh. While this system has lots of benefits, it has a flip side too. Let's look at banking challenges and limitations:

Low Online Literacy:

Online banking is facing several challenges in Bangladesh, and low digital literacy is one of them. In rural areas, most people are unable to use the online platform and find it difficult to navigate.

Technical failure:

If you have internet but can't access the bank's website to operate your account, this is called technical failure. You may have difficulty accessing your account due to technical faults or a slow or down website server.

Cyber Security Concerns:

Though online banking is secured, internet fraud and cyber risks remain. A study found that the banking sector faces a maximum of 630 cyber attacks every day. The most common attacks are phishing, malware, and ransomware.

Banks keep their security measures updated. They use 128-bit or 256-bit encryption to secure digital communication, including emails, customer service, and an automatic logout system. Also, you should apply strong passwords, never share them with anyone, and be aware of the results of cyber attacks in cyber security.

Low Internet Infrastructure:

Another obstacle to online banking is low internet infrastructure, poor internet service, slow, disrupted internet connections, power outages, etc. These problems are very common in rural areas of Bangladesh.

Limited deposit service:

If your required bank doesn't permit cash deposits in its ATM, there is no chance of cash being deposited into your account.

Lack of human interaction:

The online banking system does not allow personal customer representatives or personal service. In this case, banks introduce chatbots or live chat for customer service automated interaction that might lack personalization.

Future Prospects and Innovations of Online Banking System in Bangladesh

Online banking services have opened a new economic possibility in Bangladesh. This system, associated with physical branches, has reduced the ultimate cost of interest and services.

The world is moving fast with the blessings of technology. The online banking system is one of the best innovations in technology, and it is time-consuming and comfortable. This banking technology will improve a lot to make your work easier, portable, rapid, and swift in the long run.

Online banking will support improving financial efficiency, increase transparency, and reduce financial risks and system costs soon. Besides, online banking generates extensive data that may inspire more microfinancing and all kinds of enterprises to transact.

In the future, Bangladesh's banking system's online security will be vastly designed to protect financial information from unauthorized access. They will especially emphasize SSL/TLS protocols, high-end encryption and upgrade banks SSL (Secure Socket Layer) and TLS (Transport Layer Security) protocols.

the online banking system in Bangladesh will increase the vast opportunities for career growth for many people. As online banking, fintech, and core banking systems grow and develop, the demand for the banking profession will also increase.

Banking professions, including customer service experts, compliance officers, data specialists, risk experts, web designers, app developers, and programmers, will rise.

Bottomline

The online banking system in Bangladesh holds immense potential for boosting financial inclusion, fostering economic growth, and streamlining processes. It can flourish in the country by improving regulatory compliance, promoting online literacy, developing robust technological infrastructure, etc.

Online banking services can overcome any challenges by cooperating with the government, financial organizations, stakeholders, and technology providers.

Banking institutions must also address the latest security concerns, including two-factor authentication, regular security audits, and cybersecurity training for employees. They should also take the initiative to enhance customer experience by providing customer service training to employees.