The Future of Private Banking in Africa: Factors Analysis 2025

Africa is currently experiencing rapid economic growth. Many African countries are in a good developing state. Individuals are also making more wealth. According to the 2024 Africa Wealth Report by Henley & Partners, Africa is home to 135,200 millionaires, 342 centi-millionaires and 21 billionaires. The number of millionaires is expected to increase by 65% by 2033. The demand for personalized banking services will increase in the upcoming years.

So, there is a significant importance of private banking in Africa. This presents a huge opportunity for private banking in African countries. But there are also many challenges for private banking like regulatory, infrastructure and financial inclusion issues. In this blog, we will see what can be the future of private banking in Africa. We will try to highlight the trends, challenges, and opportunities for private banking in Africa

What is Private Banking?

Private banking is a specialised financial service designed for high-net-worth individuals (HNWIs) or organisations. Private banking services are not for the general public. The financial products are designed to provide personalised wealth management services to HNWIs. They receive financial advice, investment management, and other exclusive banking services that help preserve and grow their wealth.

Top 5 Characteristics of Private Banking:

- Personalized Services: The main characteristic of private banking is one-to-one communication with a banker who dedicately supports a client. The dedicated relationship managers understand their unique financial needs and take action accordingly.

- Customized Financial Product: Private banks offer personalized financial products for each client. They understand client goals and needs and create these financial solutions.

- Exclusive Access: Private banking clients may gain access to exclusive investment opportunities that the general public will not get.

- Confidentiality: The more the wealth, the more the privacy concern. For private banking, high levels of privacy and confidentiality are maintained. This ensures top security for clients' financial information and transactions.

- Holistic Approach: Private banking involves taking a comprehensive view of a client's financial situation. By considering all aspects of a client's finances, private bankers can use a holistic approach to manage their wealth. Private bankers may also work as financial planners or tax advisors according to their client's specific needs.

What Services Can Private Banking Offer in Africa?

Private banking provides many special financial services to high-net-worth individuals. These services are designed to help those people manage their money, keep it safe, and make sure their grandkids get it. Private banking is one of the tough segments of service for African banks'. Private banking is a challenging segment for African banks. Let's explore the services provided by private banking and how they can attract high-net-worth individuals to use these services.

1. Investment Management with Local Expertise

African private banks are increasingly offering investment management services that leverage local market knowledge and expertise. These services include regional asset allocation, investing in local industries and markets that are poised for growth. Africa has many growing industries like agriculture, mining, and technology. This brings an opportunity for good investment for the African high-net-worth individuals (HNWIs).

These banking services also provide impact investing opportunities for HNWIs. It allows investors to support projects that drive social and environmental change. Additionally, these banks offer access to emerging markets in Africa. Private banking offers investment opportunities in African markets that may not be accessible to international investors.

2. Wealth Planning for Diverse Economic Contexts

Each African country has a different economic situation. Private banks can consider this situation and offer different wealth planning services according to each country's regulatory situation. Some of the key services for wealth planning include estate planning across borders, tax advisory services, and succession planning for family businesses.

Private bankers can help clients to efficiently manage and transfer wealth across multiple jurisdictions in Africa. To optimize tax efficiency, they can provide Tax advisory services. Private banking can also offer a smooth transition for family-owned businesses. Thus private banking can help with the wealth planning of any highly rich African.

3. Customized Credit and Lending Solutions

Private banks in Africa offer personalized credit solutions to address the specific financial needs and opportunities in the region. Some of these solutions are agricultural financing, infrastructure development loans, and flexible lending terms.

Many African economies are based on Agriculture. Private banking offers Agricultural financing and provides tailored loans to support the agricultural sector. Real estate developments and energy projects are very important for Africans. Private banking can offer infrastructure development loans for rich people to create investment opportunities.

4. Advanced Digital Banking Services

Digital technology is transforming how private banking works in Africa. It is making banking services available to more people. Digital technology makes private banking more efficient.

For example, there are now mobile banking apps that let individuals easily manage their finances, monitor their investments, and conduct transactions. Private banking can use blockchain technology to make financial transactions more secure and transparent. They can use strong cybersecurity measures to protect their customer's sensitive financial information in the digital age.

5. Lifestyle and Concierge Services with a Regional Focus

Private banks in Africa are making their services better by adding lifestyle and concierge services. They are providing services based on local culture and what people want.

These services include planning exclusive travel experiences, such as safari tours within Africa. They also include invitations to high-profile events like international conferences and art exhibitions. Private banks can arrange top healthcare facilities and wellness retreats for their clients.

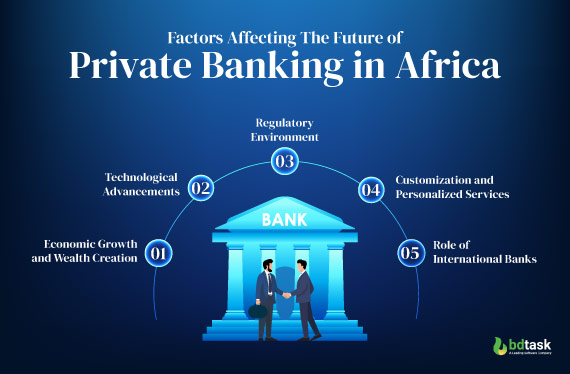

Factors Affecting The Future of Private Banking in Africa

The future of private banking in Africa is influenced by many complex factors. These factors are interrelated and affect the private banking environment in Africa. Private banks need to understand these factors and take the necessary steps to ensure the best customer acquisition. Let's take a look at the key factors that are shaping the future of private banking in Africa.

1. Economic Growth and Wealth Creation

The African continent has 54 countries, and 54 billionaires were born in Africa. But most of them are not living in Africa like Elon Musk. Only 21 African billionaires stayed in this continent. The majority of the continent's millionaires, about 56 per cent, are located in the five major countries of South Africa, Egypt, Nigeria, Kenya, and Morocco. Mauritius and Namibia are also doing very well in growing wealth in recent periods.

Middle-class people of Africa are earning money and becoming wealthy. The rising middle class are one of the main reasons for the increasing demand for private banking services.

The recent average growth rate for most of the countries is remarkable. The wealth held by African HNWIs is expected to grow significantly in the coming years which will ultimately help to grow private banking.

2. Technological Advancements

Many Private banks now offer feature-full mobile apps for private banking. Customers can use online banking from anywhere which can lead to customer satisfaction. With the continuous development of mobile apps, the user experience is increasing day by day. Users can track their portfolios and transactions and manage investments from anywhere. They can communicate with private bankers and discuss investments. Trade documents can also be shared using this app. Users can also get the latest market insights through the app.

Moreover, a fingerprint login system can provide more security for mobile apps, ultimately building trust in the user's mind. So, technological advancements in Africa may lead to an increase in wealthy individuals utilising private banking services.

3. Regulatory Environment

The regulatory environment in Africa is becoming stronger. Most governments and financial authorities are implementing policies to ensure the stability and integrity of the banking sector. Understanding and navigating these regulations is an important factor that can lead to the success of private banks.

African Continental Free Trade Area (AfCFTA) offers new opportunities and challenges for cross-border banking. Private banks must adjust to varying regulatory requirements across different countries. By adapting the varying regulations private banking services can cover more service areas.

4. Customization and Personalized Services

Clients are increasingly seeking personalised financial products. They want to meet their specific needs with custom solutions. Private banks in Africa are trying to cope with the rising demand for customised services. They are offering customized investment solutions, estate planning, tax advisory, and other services.

Building trust-based relationships with clients is at the core of private banking. Private banks in Africa need to focus on enhancing relationship management strategies. They need to analyse the customer data to provide the best service to a customer. This is essential for client retention and satisfaction.

5. Role of International Banks

Many International banks are partnering with local banks to enter the African market. These collaborations help to bring global expertise and enhance the range of services available to clients.

The entry of international banks increases competition. It is driving innovation and improving service standards in the private banking sector in Africa. So, if the local banks can establish connections with renowned international banks, the future of private banks in Africa will experience a positive change.

Conclusion

Economic development, technological innovation, and a growing rich population are influencing the growth of private banking. But to get the full potential of private banking, it's important to look into regulatory challenges, invest in infrastructure, and prioritise financial inclusion. Obviously, there are many obstacles to the growth of private banking in Africa. Every African country has their own problem that hinders growth. But, the recent data indicates that Africa can grow more in the future. More people will become rich and need services for private banking. So, we can conclude that the future of private banking in Africa is bright.