ICO Fundraising vs Crowdfunding: Top 20 Core Differences!!!

Familiar with the concept of fundraising? Have you heard about ICO fundraising and crowdfunding? Sounds similar??? Though the basement of ICO fundraising vs. crowdfunding is similar, it has a few differences. Curious to know the differences between ICO and crowdfunding? If yes, you have to invest your valuable patience and time to learn about the basic differences between ICO fundraising and crowdfunding because all of these have been explored in this article.

The concept of fundraising refers to the process of collecting funds from the investors but now the most crucial matter is what are the forms of raising these funds? In this circumstance, the concept of ICO fundraising and crowdfunding has come. So, let’s turn around the backbone in this article and jump into this ocean of which is full of ICO and crowdfunding.

What Is ICO Fundraising?

Initial Coin Offerings (ICOs) are one of the popular processes of fundraising, and the concept of ICO fundraising refers to the method of collecting a certain amount of funds from the investors to offer a token. The ICO fundraising process allows the fundraiser to raise funds for creating a token, product, or service by offering a new crypto coin and the entire activity is conducted in the Blockchain system.

Moreover, the concept of ICO fundraising has created a great revolution in Blockchain technology. In 2013, the investors introduced a new investing method which is allowed them to get new crypto coins by investing a certain amount of funds. For example, Ripple was the first cryptocurrency that has been distributed through the process of ICO.

Types of Initial Coin Offerings (ICOs)

There are two main types of Initial Coin Offering (ICO) process which will offer new tokens or crypto coins through raising a certain amount of funds. But depending on the process of collecting funds and the investor category, the type of ICOs differs from each other. So, you need to pick any of the types according to your demands and criterion.

1. Private ICO

The process of raising funds from a limited number of investors like financial institutions or high-net-worth individuals (HNWI).

2. Public ICO

The public ICO is the process to raise funds from the general public and anyone can join this network.

So, a private ICO is more secure than a public ICO due to regulatory compliance. If you want to learn more details about the types of Initial Coin Offerings (ICOs), you can check out this article.

What Is Crowdfunding?

Crowdfunding is a systematic approach to raise funds to build a particular project or a new business venture from a large number of people, groups, or individuals. There are lots of online platforms such as Kickstarter, LendingClub, Indiegogo, and GoFundMe that can help to complete the entire crowdfunding process effectively.

In addition, the crowdfunding process allows the fundraiser to raise small amounts of funds for various purposes like innovative projects, charitable projects, school tuition, business startup, personal expenses, and so on. So, the main challenge of the crowdfunding process is to reach enough people and acquire trustworthiness.

Basic Types of Crowdfunding

There are several types of crowdfunding methods but here I would like to explain only 5 basic types which will help you to understand the working pattern of the crowdfunding process. As a result, you can easily differentiate between crowdfunding and ICO.

1. Donation-Based Crowdfunding

Donation-based crowdfunding is one of the fundraising processes that allow the donors to donate a small amount of money to build a charitable project without any expectation of getting any financial return.

Moreover, donation-based crowdfunding is used for charities and social development-related activities. GoFundMe is the best online crowdfunding platform for conducting donation-based crowdfunding.

2. Reward-Based Crowdfunding

Another well-known crowdfunding process is reward-based crowdfunding. Reward-based crowdfunding is the method of collecting a certain amount of funds from the investors to make a creative project as well as through this process the fundraiser can offer rewards.

So, the investors will get financial rewards or return through investing in the reward-based crowdfunding process. Kickstarter and Indiegogo will be the best platform to invest in a reward-based crowdfunding process.

3. Equity-Based Crowdfunding

The concept of equity-based crowdfunding is the process of offering a certain part of a share of any startup to raise funds from the investors. Moreover, the investors can invest their money to receive the shares of the company or earn a financial return through this process.

So, equity-based crowdfunding will be the best practice for the new startups to quickly grow. If you want to invest through an equity-based crowdfunding process, then Wefunder, EquityNet, and Crowdfunder will be the best platform for the investors.

4. Peer-to-Peer Lending

Peer-to-peer lending is another way to raise funds from lenders but it is completely refundable with a certain interest rate. A P2P lending process is basically a form of taking loans from the lenders and the lenders will get the same amount of money with a standard interest rate within a fixed timeline.

Though this process is quite different from the rest of them, the fundraiser collects a huge amount of funds through this process. There are lots of peer-to-peer lending platforms available but Kindful, Classy, and Qgiv are the most popular lending platforms for crowdfunding.

5. Debt-Based Crowdfunding

This crowdfunding process is also refundable to the investors. Debt-based crowdfunding allows the fundraiser to raise funds from the investors but after a certain period, it will be returned to the investors with a small amount of interest.

So, debt-based crowdfunding will be the best idea to raise funds for startups or stable businesses and GoFundMe, Indiegogo, or GiveForward will be the best online platform for debt-based crowdfunding.

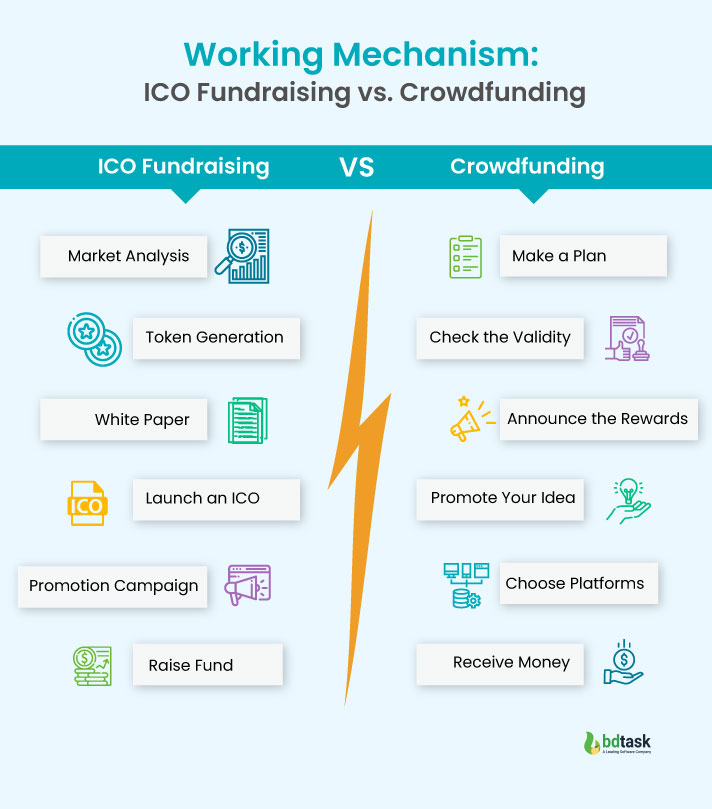

Working Mechanism of ICO Fundraising vs. Crowdfunding

The main theme of ICO fundraising and crowdfunding is to collect funds from the investors by offering several types of rewards. But the working process is different from each other and the rewarding form will also vary from ICO fundraising and crowdfunding. From this section, you can understand the difference in the working mechanism of ICO fundraising and crowdfunding.

How Does ICO Fundraising Work?

ICO is the concept of launching new tokens or crypto coins but you can not conduct the entire token launching process without any platforms. From token generating to rounding and launching every single step, you can operate through a token launching platform. Also, if you already have generated tokens, you can conduct the rest of the activities for raising funds through the token launching software.

Step 1: Identify The Investor Through Market Analysis

To raise funds through the process of ICO fundraising, the fundraisers need to identify the target audience first. By conducting market research, the fundraiser can be able to find out the target investors. Through such kinds of activities, the fundraiser provides the necessary materials or creative projects according to the demand of the targeted potential investors.

Step 2: Generate New Token

In the ICO fundraising process, the token is the main asset because the entire process is token centric and based on your created token you can conduct the entire operation to collect funds from the investors. This article provides a detailed guideline to create new tokens.

Step 3: Write a White Paper

Now, you have to describe your project details, and to do this, you need to write a complete white paper. Without knowing the details of your project, you can not make the trustworthiness and the investors do not want to invest in your project.

Step 4: Launch an ICO

This one is a very crucial step to conduct the ICO fundraising process. After preparing a complete white paper, it is the most suitable time to launch an ICO. By following some essential steps, you can launch an ICO. To do this, you can check out this article which has highlighted a complete guide on how to launch an ICO.

Step 5: Promotion Campaign

To raise funds and start the fundraising process by offering tokens or new crypto coins, you need to conduct a proper marketing campaign to promote your token. There are various online ICO listing sites that can help to promote your new tokens as well as you can easily reach out to potential investors.

Step 6: Initial Offering to Raise Fund

Finally, you can collect the funds from the investors by offering your generated tokens. Moreover, you can offer your token through a rounding process, and the entire process is conducted in the Blockchain network.

So, the fundraiser can collect funds from the investors and the investors invest a certain amount of fiat currencies or other cryptocurrencies to buy this token. After a certain period, the investor will get weekly, monthly, and yearly ROI according to their purchased package.

How Does Crowdfunding Work?

When you consider the working process of crowdfunding, it is a very common form to collect money from a large number of people, groups, or individuals.

If you have a startup or small business organization, and you need a lot of capital to grow your business, you can apply this technique to raise funds by offering various types of rewards.

Through this process, you need to show the value of your project, then the investors will invest their money in your project and you can raise funds. If the startup meets the goal by collecting funds in this way, the investors will also be rewarded.

Step 1: Make a Plan for Your Project

If you want to raise funds through the crowdfunding process, you need to make an effective plan for your project. Without creating an effective and unique concept, no one will not be interested to invest in your project.

Step 2: Check the Validity of Your Idea

Idea assessment is one of the essential steps to maintain the entire mechanism of the crowdfunding process. As a project owner or plan builder, you need to check the authenticity of your idea. In this regard, you have to ensure the uniqueness and effectiveness of your plan.

Step 3: Announce the Rewards

Through conducting the crowdfunding process, you have to announce the rewards. Otherwise, you can not catch the attention of your targeted investors. So, you need to provide clear information about the rewards when any investors invest their money in your project.

Step 4: Promote Your Idea

To complete the crowdfunding process, you also need to promote your idea. To do this, you have to apply various marketing strategies and promotional campaigns to reach out to potential investors. Through conducting such kinds of promotion, the investors will learn about your project and you can play a psychological game with them.

Step 5: Choose Crowdfunding Platforms to Post Your Project

Finally, you have to choose a crowdfunding platform to raise funds from the investors. Without any platforms, you can not collect the funds. In this step, you need to select some well-known platform according to the purpose of your business as well as you have to post the details of your project on these platforms.

Now, the fundraiser can raise money and provide a certain amount of rewards to the investors.

So, this process can provide the fundraiser not only financial support but also help to observe the market demand.

Which Factors Make the Differences Between ICO Fundraising and Crowdfunding?

You have already realized the technical differences between ICO fundraising and crowdfunding. Also, there are some significant factors that are the reason to create the distinction between ICO and crowdfunding.

Reward Type

The main difference between ICO fundraising and crowdfunding is the reward form. When any investors invest in their fiat currencies or any cryptocurrency, they will get a reward as a tokenized form. The fundraiser can raise funds by offering a new token, and the entire fundraising process is operated through Blockchain technology.

On the other hand, when it has come into the concept of crowdfunding, the investor will get various forms of rewards such as return money with an interest rate, gift voucher, company’s share. Also, this process allows the fundraiser to raise funds as a bank loan or donation for charitable organizations from the investors.

Accessibility to Raise Fund

If the fundraiser wants to raise funds through the ICO fundraising process, it can allow the fundraiser to access this process from a wider range of countries or regions. Also, you can make it popular by advertising on social media networks. So, the fundraiser can access the ICO fundraising process from any allowed countries or regions.

On the other hand, the crowdfunding system is limited to specific countries or regions. It has a lot of limitations to access and the fundraiser will face many difficulties to conduct the operation. So, the fundraisers can not access this fundraising process from anywhere.

Fundraising Campaign Duration

Time is the most remarkable factor to distinguish ICO fundraising and crowdfunding. Through the ICO fundraising process, the fundraiser can quickly raise the funds within weeks to minutes, or seconds. For example, Brave browser startup has raised $35 million within 30 seconds by offering Basic Attention Token (BAT).

Also, the SingularityNET project has distributed the AGI tokens and raised $36 million within 60 seconds. So, this process is one of the fastest ways to raise funds from investors.

On the contrary, the crowdfunding process is slower than ICO fundraising. Through the crowdfunding process to raise funds from the investors, it would take a lot of time suppose that a few months or years. So, it will not be suitable for independent startups.

Fundraising Risks

The fundraiser also needs to consider the risk to raise funds and maintain the entire fundraising process. The ICO fundraising process is conducted in the Blockchain network, and it is completely uncertain. The ROI will depend on the market value of the offered token. Moreover, the fundraiser will not know the future market value of their offered token. So, it is more risky and unpredictable for the fundraiser and investors as well.

On the other side, the crowdfunding process allows the investors to know about the rewards before investing. Also, this process is all funds-centric because the fundraiser will raise the funds to build any project. After completing the project, if they fulfill their target and meet their goal, the fundraiser and investors both are benefited. So, this process is comparatively less risky than ICO fundraising.

Laws and Regulations

Another differentiating factor between ICO fundraising and crowdfunding is laws and regulations.

If you consider ICO fundraising, it has been restricted for many countries, so this fundraising process is not regulated by the laws and regulations of all countries. But there are many countries such as the United States, United Kingdom, Switzerland, Australia, and so on. These countries are allowed ICO fundraising. Besides, the ICO fundraising process has been totally banned in China and South Korea.

On the other hand, crowdfunding is more regulated than the ICO fundraising process. Most countries allow crowdfunding to raise funds, and the crowdfunding platforms are registered by the laws according to the country. For example, the US, UK, Canada, Australia, New Zealand, Austria, Singapore, and so on. Since crowdfunding is less risky than ICO fundraising, many countries provide some specific rules and laws to raise funds in this process.

Return on Investment (ROI)

The ICO fundraising process allows the fundraiser to raise funds by distributing new crypto coins or tokens. Through purchasing tokens or crypto coins, investors will get a certain amount of profit according to the market value of their purchased token. So, the ROI fully depends on the value of the token and the investors will get it weekly, monthly, or yearly basis.

On the other hand, there are various types of crowdfunding methods, and depending on the type the investors will be rewarded. Also, the fundraiser can collect the funds as a bank loan, in this case, the lender will get return the same amount of money with a certain interest rate. Moreover, the form of ROI will vary based on which method will follow the fundraiser. Sometimes, the investors may not get any return if the fundraiser applies a donation-based crowdfunding method.

Comparison Chart: ICO Fundraising vs. Crowdfunding

Here, I will provide a comparison chart between ICO fundraising and crowdfunding that will assist you to easily understand the key differences between them. Here, I would like to provide the top 20 core aspects of ICO fundraising vs. crowdfunding. So, take a glance into the following chart to learn about it.

|

Serial No. |

Core Aspects |

ICO Fundraising |

Crowdfunding |

|

1. |

Investors |

Blockchain Investors |

Angel Investors |

|

2. |

Issuers |

Small & Mid-size Enterprise, Startups, Large Companies |

New Startups, Small and mid-size enterprise |

|

3. |

Product |

New Crypto Coin |

Varies |

|

4. |

Duration |

3 to 6 months |

1 to 3 months |

|

5. |

Requirements |

New coin, White Paper, Launching Platform |

Project Description, Reward types, Facilities |

|

6. |

Funding Currency |

Crypto |

Fiat |

|

7. |

Accessibility |

Wider Range of Countries |

Limited Countries |

|

8. |

Fundraising Cost |

Low |

Moderate |

|

9. |

Risks |

Comparative High |

Medium |

|

10. |

Technology |

Blockchain |

AI & Blockchain |

|

11. |

Investment Platform |

Customize Platform |

Kickstarter, Indiegogo, GoFundMe, and so on |

|

12. |

Laws & Regulations |

No Regulation |

Country-based |

|

13. |

Rewards |

Rewards |

Pledges |

|

14. |

Marketing Strategy |

ICO Listing Sites, Social Media |

Social Media, Promotional Campaign |

|

15. |

Target Audience |

Global |

Regional |

|

16. |

Liquidity |

High |

Low |

|

17. |

Intermediaries |

No |

Platforms |

|

18. |

Network |

Decentralized |

Centralized |

|

19. |

Security or Assurance |

No |

Yes |

|

20. |

Asymmetric Information |

Highest |

Average |

So, I think you have to understand the core differences between ICO fundraising and crowdfunding. Now, you can choose anyone to raise funds from the investors.

Choose Your Preferable One!!!

Have Any SMEs or Large Companies???

If you have any small or medium-sized enterprises, or startups, or large companies, it would be better to pick out ICO fundraising to collect funds from the investors. In this regard, you must have to build a token launching platform that will aid you to complete the entire process.

Definitely, you have learned about the token launching process, but still, if you do not know it, quickly go through this article. Through releasing a new coin, the fundraiser can collect funds and conduct the rest of the process. But without a smart solution or token launching script, the fundraiser can not release their new token. Also, the investors can not invest by purchasing their tokens.

Launch Your Token to Raise Funds with an Optimum ICO Solution!!!

The token launching software acts as mitochondria of the entire process. As mitochondria provide the power of the whole cell, the ICO script software manages the overall operation in an effective and organized way.

In this case, you can go for ICO Wallet software which will assist you to sustain yourself in this competitive crypto industry.

Ending Line

The main purpose of this article is to illustrate the key differences between ICO fundraising and crowdfunding. Here, I have tried to explore every single point of ICO and crowdfunding that will assist you to observe the basic differences between the two fundraising processes. From this article, you can easily differentiate the definition and working mechanism of them. Also, some significant factors are discussed that will help you to compare them.

Read More: