Business Budget: Core Aspects and 5 Steps to Create!

Want to know about the business budget? Do you have any business? Want to start a business? Don’t forget! You must need to know the concept of preparing a business budget. You can make a budget that allows you to see how much money you have, how much money you've spent, and how much money you'll require in the future. If you run out of money, the budget can help you adjust your business plan or prioritize your spending on different tasks. According to a statistic,

“Around 54% of businesses can prepare a complete business budget to conduct the overall operation of their business.” Source

In this article, you will get a definitive guide on business budgets which will include the types and components of business budgets, as well as how you can create a business budget.

What Is a Business Budget?

A business budget refers to a complete spending plan based on your income and costs for your company. A business budget can be able to determine the available capital, total spending, and net income. It assists to plan your business activities and serves as a benchmark for establishing financial goals to overcome short-term challenges as well as long-term plans.

Moreover, a business budget gives you a clear picture of your expenses and income, and it should help you make crucial decisions like whether to enhance marketing, lower costs, employ people, buy equipment, and improve efficiencies in other ways. You can specify your company's financial and operational objectives.

You Might Also Like: 15 Best Business Management Software of 2025

What Are the Types of Business Budgets?

There are various types of business budgets used to conduct the overall activities of an organization. In this regard, you have to choose a suitable business budget type that will be compatible with your business. But there are many organizations that use more than one type of budget according to their company’s size, needs, and operations.

In this section, I would like to illustrate the 7 types of the business budget that will assist you to draft your business plan accurately. So, let’s take a look and explore the types of business budgets.

1. Static Budget

A static budget is one that employs estimated quantities for a specific period prior to the start of the period. Moreover, a static budget is distinct in that it does not fluctuate regardless of revenue or spending fluctuations. As a result, the static budget is frequently used to assess a company's success throughout time.

The static budget is a useful instrument of your business budget for tracking spending and revenue-generating because it does not alter. Assuming that the static budget is created with optimal financial performance in mind. So, it aids in keeping the company working in the most beneficial direction.

2. Cash Budget

A cash flow budget can calculate the overall amount of money that enters and exits an organization over a given period of time. Moreover, you can create a cash budget from the entire calculation of sales projections and production, as well as predicting payables and receivables.

However, it can assist you to determine whether you have enough liquid cash to operate, whether your money is being used wisely, and whether you are on track to make a profit. Also, you can automatically calculate the entire cash flow management through an automated system.

3. Master Budget

A master budget refers to a compilation of lower-level budgets which is prepared by various organizational functional divisions. You can take input data from financial statements, cash forecasts, and financial plans. Moreover, the Master business budgets can be used by management teams. It helps to execute the plans and take required actions to meet their corporate objectives.

Moreover, the master budget is produced through numerous iterations, and senior management in larger organizations is in charge and can do it before it is finalized. To conduct your company’s activities, you can allocate your master budget. You can use spreadsheets to build your master budgets, but using effective budgeting software will help to reduce errors.

4. Labor Budget

To meet all the objectives of your organization, you need to create a labor budget. You can easily predict the required cost and manage your workforce. You can meet your objectives so you can plan your payroll accordingly through the labor budget.

It not only aids in the planning of regular personnel but also aids in the allocation of expenses for seasonal workers. Moreover, the direct labor budget is useful for forecasting the number of people required to staff the production area over the course of the budget year.

5. Capital Budget

You can evaluate possible big projects or investments through the capital budget. Before approving or denying any project, you need to prepare the capital budget. Moreover, it is the construction of a new facility or a large investment in an outside business.

It helps to evaluate a prospective project's lifetime cash inflows and outflows as part of the capital budget. As well as, you can see if the anticipated returns generated match an acceptable target benchmark.

6. Financial Budget

Organizations create a financial budget in order to better manage cash flow. This budget gives the company more control over its finances and a more effective planning system for managing inflows and outflows.

However, it is necessary to prepare the operating budget initially in order to prepare such a budget. The firm can forecast sales and manufacturing costs with the help of the operational budget. As a result, the organization creates this budget only after the various funding operations in the operating budget have been planned.

7. Operating Budget

You can determine a company's projected revenue and expenses over a set period of time by creating an operating budget. It's a lot like a profit and loss statement. These factors like fixed costs, capital costs, variable costs, and non-operating expenses are all included in this type of budget.

Moreover, this data is useful for determining whether the company is spending in accordance with its budget. The management of most firms develops this budget at the start of each year. The document is updated on a monthly or quarterly basis throughout the year and can be used as a prediction for multiple years.

You Might Also Like: Top 25 Small Business Ideas for Rural Areas

Basic Components of Business Budget

To build your business plan, you have to explain all of the components of the business budget. If you want to start a new business, you need to prepare a detailed business budget. Though it might be challenging to create a business budget, it will be fruitful to conduct the operation of your business.

Moreover, you can easily prepare a complete budget if you have enough knowledge about the basic components. In this section, you can learn about the essential components which will need to create a business budget accurately.

Net Income

This is the amount of money you get from each paycheck. Wages minus taxes, retirement payments, employer-sponsored healthcare bills, and other expenses equal net income. It also includes your spouse's wages if you're married. You can calculate the Net Income by using the following formula:

Net Income = Total Revenue — Total Expenses

Money earned from investments, part-time work, and even alimony is included. To have an accurate budget, it's critical to include everything. You should also record the money you actually receive rather than the amount you anticipate receiving. However, you do not include child support payments in your income if you are supposed to get them but do not receive them on a regular basis.

Estimated Revenue

The estimated revenue has two main components: sales forecast, and estimated cost of goods sold or services rendered. Moreover, this is the amount of money you anticipate your company making from the sale of goods and services for a given accounting period. You can predict your revenue by using the formula:

Estimated Revenue = Price * Estimated Quantity Sold

You need to use your previous experience to estimate these components if your company is more than a year old. Also, if your company is brand new, you can look up the revenue of similar area businesses and utilize that information to generate some conservative revenue estimates. But if your company is new or established, it is critical to remain realistic in order to prevent overestimating.

Fixed Cost

If your company pays the same amount for a specific expense on a regular basis, it would be considered a fixed cost. Building rent, mortgage or utility payments, employee salary, internet service, accountancy services, and insurance premiums are all examples of fixed costs.

You can calculate the Fixed Cost by using the following formula:

Fixed costs = Total production costs — (Variable cost per unit * Number of units produced)

Moreover, it's critical to factor these costs into your budget so that you can set aside the exact amount of money needed to cover them.

Variable Cost

There are various costs that might be included in your business budget which can fluctuate based on your needs. You need to mention all variable costs in your budget. Otherwise, you can not undertake the cost volume profit (CVP). To calculate the variable cost, you can use this formula:

Total Variable Costs = Cost Per Unit x Total Number of Units

Moreover, you can calculate the contribution margin that will be used to determine profitable products and better resource allocation for your business. The variable cost might be increased or decreased based on the company’s production and sales volume. If your production is increased, your variable cost will be increased as well.

One-time Expenses

Those expenses are one-time, unanticipated expenses that your company may face in any given year. Replacing broken accessories or purchasing a product are two instances of these expenses.

To guarantee that the owner/managers obtain a realistic view of the company's operating potential. Moreover, one-time expenses and revenues are not included in the calculation of operating income. They are, nevertheless, included in net income prior to the calculation of income taxes.

Cash Flow

This is the cash that flows in and out of the company. You can estimate it based on previous financial records and utilize that data to protect your profits for the year you're budgeting for. Moreover, the cash flow statement has three main components: Operating activities, investing activities, and financing activities. To calculate the overall cash flow, you can use this formula:

Free Cash Flow = Net income + Depreciation/Amortization – Change in Working Capital – Capital Expenditure

Operating Cash Flow = Operating Income + Depreciation – Taxes + Change in Working Capital

Cash Flow Forecast = Beginning Cash + Projected Inflows – Projected Outflows = Ending Cash

Also, you can be able to keep track of not only how much money is coming in, but also when it is coming in. So, you have to know when your cash flow is highest which will assist you to plan when to make large purchases or investments if your firm has a peak season and a dry season.

Profit

Profit is a measure of a company's worth that analysts use to assist investors in making informed decisions. Moreover, profit is the final budget component, which is calculated by subtracting expected costs from revenue. You can calculate the total profit by using this formula:

Profit = Total Revenue - Total Expenses

You can understand the growth of your company act as a positive indicator. You will be able to decide how much to invest in each functional area of your company once you have estimated how much profit you will make in a year.

You Might Also Like: Most Profitable Restaurant Type To Make More Money

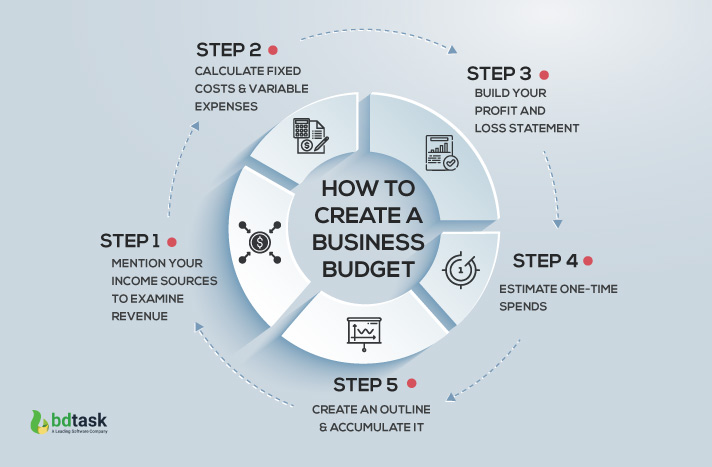

How to Create a Business Budget?

Before creating a business budget, you need to know the essential steps. Otherwise, you can not prepare your budget properly. Moreover, it summarizes important information about your present financial situation (including income and expenses) as well as your long-term financial objectives. So, it is crucial to create an accurate business budget.

Here you can understand 5 simple steps to create your business budget easily and accurately.

Step 1: Mention Your Income Sources to Examine Revenue

At first, you have to mention your earning sources that how much money your company brings in each month, and where that money comes from. In this regard, you have to add all of the income sources that will assist you to discover how much money comes into your business monthly.

After finding your income sources, you can calculate your revenue. When calculating your income, be sure you're looking at revenue rather than profit. Before expenses are eliminated, you have to enter your revenue into your business budget. After expenses are eliminated, profit is what is left.

You need to calculate your monthly income after you have identified all of your sources of revenue. It's critical to conduct this over a period of months - preferably at least the prior 12 months if you have that much data.

You Might Also Like: Pharmacy Business Plan - Tips & Tricks

Step 2: Calculate Fixed Costs & Variable Expenses

Adding up all of your fixed costs is the second stage in generating a business budget. Any expenditure that is required on a recurring basis for the running of your firm is referred to as fixed costs. You can calculate your fixed costs based on a daily, weekly, monthly or even yearly basis, so gather as much information as possible.

You have to calculate the fixed costs through the following factors:

- Rent

- Supplies

- Debt repayment.

- Payroll

- Depreciation of assets

- Taxes

- Insurances

Also, you need to find out the following aspects that will assist you to identify variable expenses:

- Owner’s salary

- Replacing old equipment

- Office supplies

- Professional development

- Marketing costs

- Utilities

You Might Also Like: 10 Inevitable Steps to Shape your eCommerce Business Plan

Step 3: Build Your Profit and Loss Statement

After accumulating all of the above information, you need to put it all together and create your profit and loss statement (P&L). There are some key components that will need to know to create a profit and loss statement. These are:

- Revenue

- Cost of goods sold (COGS)

- Expenses

- Gross profit

- Net profit or loss

To create a complete profit and loss statement (P&L), you need to know the following steps.

- Collect all required information about revenue and expense

- List all of your sales information

- List your COGS

- Get gross profit by subtracting COGS from gross revenue

- List all expenses. Then, get EBITDA by subtracting the expense from gross profit.

- List all interest on business debt, taxes on net income, as well as, depreciation and amortization.

Step 4: Estimate One-Time Spends

You need to pay each month many of your business expenses and cost. Whether it would be fixed or variable. However, you have to bear a fixed amount of expenditures that will occur significantly less frequently. Just remember to include those costs in your budget as well.

If you know you will have one-time expenses coming up. For example, you will need a business course or a new laptop including them in your budget. It will help you set aside the funds you will need to cover them and prevent your company from a huge financial setback.

Step 5: Create an Outline & Accumulate It

This one is the final step and you need to create an entire outline to organize the overall business budget.

In this step, you have to gather all of your sources of income as well as all of your outgoings. What comes next? Putting it all together to get a full picture of your monthly financial situation.

To calculate your overall profitability, you need to combine your total income and total expenses, then compare cash flow in (income) to cash flow out (expenses).

You Might Also Like: Do I Need A Business License To Sell Online?

Wrap Up

You have reached the ending part of this article. From this article, you have easily learned about the core aspect of a business budget. A business budget can assist you in forecasting cash flow, identifying functional areas for improvement, and running your business smoothly.

For new businesses, creating a budget can be intimidating because there are no previous figures to guide their budget estimates. So, this article will be very helpful to create your business budget successfully.

Read Also: